Refinancing of Restructured Loans while Managing Financial Challenges

This case study examines how the firm navigated financial challenges exacerbated by the COVID-19 pandemic through strategic loan management and restructuring.

Introduction

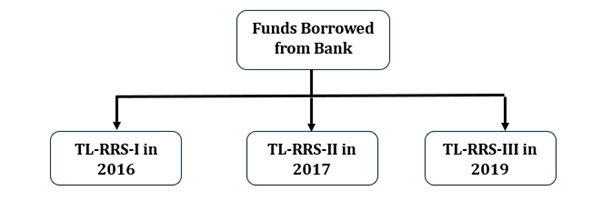

Founded in 1994, the group has established itself as a prominent real estate player in the residential and commercial real estate development sector in Maharashtra, the firm operates a mall which was constructed and operational since March 2016. Following the operational launch of the mall, the firm secured funds time to time from bank under Reality Rental Scheme (LRD Scheme) against the lease income receivables from the mall, enabling the firm to leverage its rental income for financing. The firm’s financial prudence was highlighted by its ability to repay these loans in advance, reflecting a strong liquidity position and effective debt management strategies.

Pre-Pandemic Financial Performance

Operationally, the mall boasted high occupancy rates and a diverse mix of tenants, including retail outlets, restaurants, and entertainment facilities, which contributed to a steady and robust revenue stream which includes revenue sharing income. The firm’s efficient management of operational costs and maintenance further enhanced the mall’s appeal to both tenants and customers, bolstering its financial health. The firm’s overall debt-to-equity ratio was decent considering the LRD loans which are self-liquidating in nature, indicating sound financial leverage and a solid equity base, which facilitated favourable borrowing terms from lenders. The firm’s consistent cash flows from lease rentals and revenue sharing income not only supported its debt obligations but also allowed for reinvestment in growth opportunities without overextending its financial resources.

Impact of COVID-19 Pandemic

The COVID-19 pandemic, which began impacting businesses globally in early 2020, had a significant adverse effect on the firm’s operations. In response to government-mandated lockdowns, the mall was forced to close temporarily, disrupting business activities. The lockdown period lasted for two months, and even after reopening in June 2020, the business environment remained subdued, as the government had levied restrictions on social gathering, social functions etc. which made the firm to operate mall with restrictions due to which business got affected. Tenants faced financial challenges, leading to delays in lease payments and revenue-sharing income.

Financial Strain and Loan Repayment Challenges

The COVID-19 pandemic brought unprecedented financial strain to the firm, which had previously enjoyed robust financial health. With the government-mandated lockdowns starting in March 2020, the mall had to shut its doors, leading to zero revenue for the tenants and, consequently, no income for the firm. Tenants were unable to pay rent, and no revenue-sharing amounts were received due to the halt in business activities. As businesses within the mall struggled to survive, the firm faced a cascade of financial difficulties. Revenue sharing income came to a halt, and lease rental income, which was the backbone of the firm’s financial strategy, dwindled to near zero. Tenants either sought waivers or delayed payments, causing a significant liquidity crunch.

At the time of the lockdown, the firm was unable to pay the EMIs, but despite no debt repayment during the Covid-19 lockdown the firm’s debt repayment was advance till September 2020. However, even after the 4-decade old relationship and satisfactory repayment history and strong potential, the bank did not support the firm with a moratorium period/ moratorium interest loan, or any other benefits. This lack of support left the firm with no choice but to opt for restructuring, even though they had always been proactive in making advance payments. This delay in repayments posed a risk of the loans being classified as Non-Performing Assets (NPAs), which would further strain the firm’s financial health and creditworthiness. Thus, the firm took the route of restructuring of all loans.

Restructuring Under Kamath Committee Guidelines

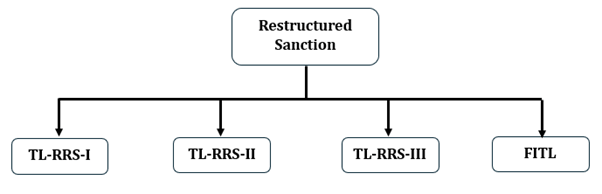

To address the financial strain caused by the pandemic, the firm opted for a review and restructuring of its existing credit facilities under the guidelines set by the Kamath Committee. This committee was established by the Reserve Bank of India (RBI) to provide relief to businesses impacted by the COVID-19 pandemic through restructuring of loans without classifying them as Non-Performing Assets (NPAs).

In early 2021, the firm underwent a detailed review of its financial situation, including cash flow projections and debt obligations. Based on this review, the firm approached Bank for restructuring its LRD loans. The restructuring proposal, aimed at aligning debt repayment terms with the revised cash flow projections post-pandemic, was sanctioned on June 2021.

Refinancing the Loan to remove the tag of restructured account and better terms & conditions

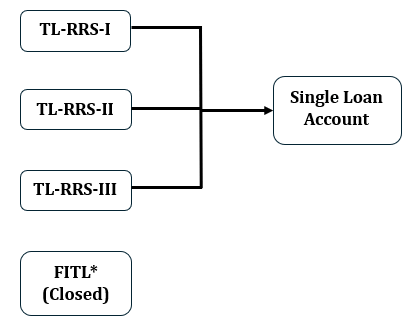

Despite the successful restructuring, the firm decided to improve its financial standing and remove the stigma of a restructured account. In March 2023, the firm undertook the strategic decision to take over the loan from the existing bank and opt for another scheduled bank. This strategic move aimed to remove the restructuring tag associated with the accounts and aimed to secure better pricing, enhanced limit, increased repayment period, and consolidate the three accounts into a single loan facility.

After takeover, the three accounts have converted into one single account and the firm has foreclosed the FITL from internal accruals before disbursement of the LRD Facilities.

Challenges Faced by the Firm due to Covid-19 Outbreak

- Operational Disruption: The sudden closure of the mall and subsequent subdued business environment during the pandemic significantly impacted revenue generation and cash flow stability.

- Financial Distress: The reduced lease income and challenges in lease receivables during the lockdown period strained the firm’s ability to meet its financial obligations, leading to difficulties in servicing EMIs on time.

- Lack of Bank Support: The bank did not provide support during the lockdown period in the form of moratorium period/ moratorium interest, despite the firm’s more than 4-decade old relationship and satisfactory track record.

- Restructuring Complexity: Navigating the restructuring process under the Kamath Committee guidelines required detailed financial assessments, negotiations with the lender, and adherence to regulatory frameworks. It involved restructuring terms and conditions to align with the firm’s revised financial projections and cash flow capabilities. However, the firm successfully satisfied all the criteria and accomplished the restructuring.

- Complexity of Restructured Account Takeover: Successfully transitioning the restructured account to a scheduled Bank posted significant administrative and regulatory challenges. Ensuring compliance with new lender requirements and overcoming initial lender resistance required meticulous planning and execution which the firm successfully achieved through the consultation of financial consultants.

Benefits of Loan Takeover to the Firm

- Enhanced Loan Limits: Takeover facilitated an enhanced loan limit, potentially providing access to additional funding if needed for future expansions or operational needs.

- Extended Repayment Period: Negotiating with a new lender allowed for a longer repayment period, easing immediate cash flow pressures and aligning repayment schedules with revenue generation. This facilitated the firm to enjoy financial liquidity with flexible repayment as the EMIs were fixed @Rs.1.27cr for the whole loan tenure.

- Reduced Interest Rates: The firm secured reduced interest rates through the takeover, resulting in lower overall financing costs and improved profitability over the loan tenure.

- Multiple to Single Account: The takeover made smooth operation for the firm from handling multiple accounts to a single account.

- Removal of Restructured Account Tag: Transferring the loans to another scheduled Bank removed the stigma associated with a restructured account, enhancing the firm’s creditworthiness and standing in the financial market.

Conclusion

This case study illustrates the firm’s resilience and proactive financial management in response to unprecedented challenges posed by the COVID-19 pandemic. By leveraging restructuring options under regulatory guidelines, the firm successfully mitigated financial distress and regained stability. The decision to transfer the restructured loans to another Bank in March 2023 reflects the firm’s strategic approach to optimizing financial arrangements, positioning itself for sustainable growth in the post-pandemic economic landscape and removal of restructured account tag.

Through effective restructuring and strategic financial decisions, the firm not only navigated through a period of financial uncertainty but also emerged stronger, with improved financial resilience and flexibility to pursue future growth opportunities.

Read more : Refinancing of Loans of a Resort Chain to Match the Debt Repayments with the Projected Cash Inflows

Aute mi ut suspendisse velit leo, vel risus ac. Amet dui dignissim fermentum malesuada auctor volutpat, vestibulum ipsum nulla.

Sed reprehenderit quam, non felis, erat cum a, gravida lorem a. Ultricies in pellentesque ipsum arcu ipsum ridiculus velit magna, ut a elit est. Ultricies metus arcu sed massa. Massa suspendisse lorem turpis ac.

Massa suspendisse lorem turpis ac. Pellentesque volutpat faucibus pellentesque velit in, leo odio molestie, magnis vitae condimentum.