Refinancing of Loans of a Resort Chain to Match the Debt Repayments with the Projected Cash Inflows

Since 2006, a prominent Indian hospitality group has operated resorts across multiple cities with a total room inventory exceeding 300 rooms. Backed by over 35 years of experience in the hotel and restaurant business, the group has successfully managed a diversified portfolio under two entities: ABC Company and XYZ LLP.

The management team has a cumulative experience of over 100 years expertise in real estate, property development, brand building and management of resort and spa. Management team’s multi-disciplinary skills and experience in strategic land acquisition, resort & spa design and construction, global sourcing of interiors and strength in international marketing and finally creating a pool of repeat customers.

The company entered into share subscription agreement with an investment company in 2010 for an aggregate investment of Rs.40Cr against 40% stake (on fully diluted basis) in the company towards development and implementation of the hospitality projects having aggregate project cost of Rs.100Cr.

The company had availed loan from a Public Sector Bank of Rs.50Cr against security of owned and operated resorts.

During COVID, the group availed the COVID support loans under the ECLGS Scheme from the existing bankers, repayable in 4 years after a moratorium period of 2 years.

Funding the Exit of Investors

As discussed, the current shareholding includes 40% shareholding by investment company of HDFC Ltd. On July 1, 2023, HDFC Ltd. merged with HDFC Bank, leading to the investment company becoming a subsidiary of HDFC Bank. Thus, all RBI regulations which are applicable to the investment company got triggered.

As per the terms of Section 19 (2) of the Banking Regulation Act, 1949, a bank cannot hold shares in excess of 30% of the paid-up share capital of a company. Shareholding in the company of HDFC & Crystal Mauritius is 43%.

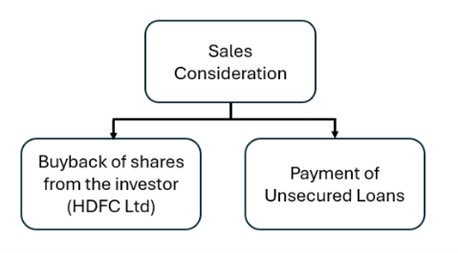

Upon the merger of HDFC Ltd. and HDFC Bank, regulation 19(2) gets triggered and needs to be rectified during the transition period. There are multiple other instances within HDFC Bank where the merger has caused the trigger of Reg. 19(2). Thus, HDFC Bank is in the process of cleaning its balance sheet to comply with Reg. 19(2) and accordingly, the company has received a golden parachute opportunity wherein the investors have agreed to exit at Rs.24Cr valuation of their equity. However, considering their compliance deadlines, the investors want to exit in Q2FY2024 itself, and HDFC Bank is targeting closure of all its accounts PAN India by Q3FY2024.

The Company had agreed to give the exit to the investor (HDFC Bank) at an agreed valuation. Funding for this was to be arranged.

Funding for the Buyback of the share from the Investor

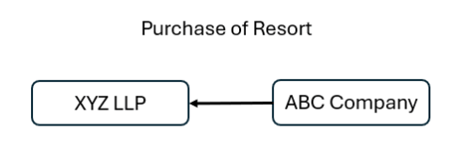

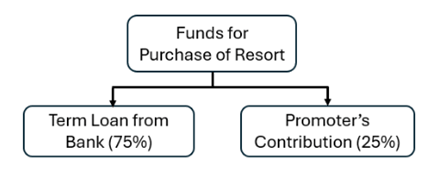

The Company (ABC) sold a resort to its group entity (XYZ) at a consideration against which XYZ LLP availed Term Loan from another bank (75% of purchase consideration).

The purchase consideration was used towards payment of the buyback consideration to the investing entity.

Refinancing the Loan Repayment Schedule in Line with Cash Flows

Since the group exposure now increased to the extent of fresh sanction of term loan. The group anticipated that the future cash flows will not be sufficient to service the upcoming interest and principal repayments.

Because of that the group in FY2024 approached an NBFC for the takeover of the existing credit facilities taken from the Bank with enhancement for competitive pricing and better terms & conditions which will enhance the financial position and contribute to the sustainable development of the group.

Why the group choose to go for NBFC and not for the Bank?

As per RBI Prudential Framework for Resolution of Stressed Assets dtd. 07.06.2019. Modification of terms of the advances including alteration of repayment schedule

“The accounts classified as ‘standard’ shall be immediately downgraded as non-performing assets (NPAs)” The account cannot be upgraded before 1 year from the commencement of the 1st payment of interest or principal (whichever is later) on the credit facility with longest period of moratorium under the terms of RP.

Accordingly, it is not feasible to restructure / change the repayment schedule to allow for a more relaxed repayment structure.

However, when changing the repayment schedule through NBFC this norm is not applicable, and the account will remain standard.

Because of that, the group refinanced its loan facilities with an NBFC at a higher cost but aligned the repayment schedule with its projected cash flows.

After one year, the Group will plan to transfer back to the Bank at a lower ROI, whereby the norms of restructuring will not be applicable, and loan will continue under standard category with comfortable cash flows.

Read More : Refinancing of Restructured Loans while Managing Financial Challenges

Aute mi ut suspendisse velit leo, vel risus ac. Amet dui dignissim fermentum malesuada auctor volutpat, vestibulum ipsum nulla.

Sed reprehenderit quam, non felis, erat cum a, gravida lorem a. Ultricies in pellentesque ipsum arcu ipsum ridiculus velit magna, ut a elit est. Ultricies metus arcu sed massa. Massa suspendisse lorem turpis ac.

Massa suspendisse lorem turpis ac. Pellentesque volutpat faucibus pellentesque velit in, leo odio molestie, magnis vitae condimentum.